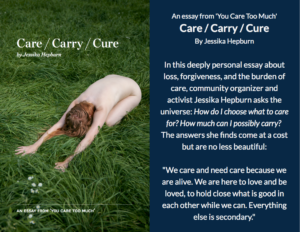

In Canada, tax season has just come and gone and I’m sure everyone has heard a story of *someone* who took a shoebox of unsorted receipts to their accountant and hoped they could sort it all out. Keeping your files in order is perhaps a bland topic, but it can be crucial to the efficiency of your business. It took me four years to get my filing system set up in an appropriate and yes, industry standard way. If you haven’t worked in an office setting with a well-structured filing system, or perhaps never were required to access it yourself, you may be struggling with how to effectively organize your files. Hint: It is not a shoe box.

Step 1: You will need a filing cabinet.

It doesn’t have to be fancy, but it should have working drawers and, if you have young children, be sure it has a latch or lock. I pick my papers up off the floor at least four times a day and put them all back in lest my toddler take them all out again. I’ve tried taping the drawer shut. It doesn’t work.

Above: Vintage industrial filing drawer from Haven Vintage

Step 2: Purchase file folders & file folder hangers.

Dress up boring folders with this tutorial from Elsie of A Beautiful Mess on the ModCloth blog

Step 3: Categorize your business accounts.

My business is mainly based on wholesale accounts. In broad terms my accounts include raw material suppliers, wholesale customers and retail customers.

- Raw materials suppliers and office expenses are PAYABLE accounts – accounts I need to pay.

- Wholesale and retail customers comprise the RECEIVABLES accounts – incoming revenue.

As invoices and bills arrive you may enter them into accounting software or accumulate them for your book keeper or accountant to handle. To simplify the account reconciliations, you can further break down your PAYABLES into the following:

- Payables Bank – all invoices that will be paid by electronic payment or cheque.

- Payables Credit Card – all invoices that will be paid by credit card.

- Payables PayPal – all invoices paid from my PayPal account

Once the invoices have been posted or entered into your accounting software, they can be filed away for storage. My system is set up like this:

- PAYABLES: Create a folder for each supplier. File it in your filing cabinet alphabetically. Keep all correspondence related to each supplier in their designated folder. This includes invoices, catalogues, samples, etc.

- RECEIVABLES: Create a folder for each customer account. If you have wholesale accounts, keep a folder for each one to hold invoices, credit applications, retailer applications, correspondence. You may want to keep a monthly folder for retail sales rather than individual account folders. File alphabetically.

Keeping your papers in order will save you a lot of time and effort not only at tax time, but on a day to day basis as you run your business. Small efficiencies like this can make a significant amount of difference to a small-scale business.

Share your best filing tips & supplies with us in the comments!