Also in this series: {Part 2: Contracts} | {Part 3: Structure | {Part 4:} Intellectual Property I bet you, like me, start off the New Year with huge dreams for what the year will hold. I like to pick a theme for the year. In 2015 I’m working on cultivating a strong community, both online and offline. So when I sat down and created my 2015 business plan, I made sure that the … [Read more...] about {Part 1} Dig A Business Foundation: Your Website

Resources

2015 Super Simple Intention Setter

It’s that time of year again where fresh ideas and a blank slate await! Do you find that wonderfully exciting or does it bring up some feelings of anxiety or down-right dread? For me, it’s a little of both. This is my second New Year as a mom and with a very mobile toddler running around and little sleep, I’m looking for ways to plan my year and find some focus without … [Read more...] about 2015 Super Simple Intention Setter

Make 2015 a Year Well Lived in Small Moments

Hello 2015! If you want to wake up to possibility every day this year I'm hosting 365 Days of Presence starting today and enrollment is open until the 15th of January. Here are a few of the presents I'll be delivering this year: For more information about 365 Days of Presence visit the course page here or click the banner below to register and start receiving your year of … [Read more...] about Make 2015 a Year Well Lived in Small Moments

Stop the Hustle: On Slowing Down, Stepping Up & Paying Attention

hus•tle (ˈhʌs əl) v. -tled, -tling, n. to proceed or work rapidly or energetically. to push or force one's way; jostle or shove. to be aggressive, esp. in business or other financial dealings. Slang. to earn one's living by illicit or unethical means. Slang. (of a prostitute) to solicit clients. to convey or cause to move, esp. to leave, roughly or hurriedly. … [Read more...] about Stop the Hustle: On Slowing Down, Stepping Up & Paying Attention

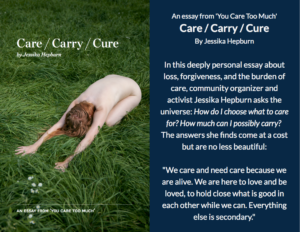

Amy Turn Sharp Writing Workshop

I met Amy Turn Sharp on an Etsy team in 2009 when we were both selling handmade goodness for kids and I fell hard for her wild words & smart mouth. We all have hearts full of stories we are afraid to tell and finding Amy’s truthful writing was like getting a permission slip from the universe to share my own. This gift helped me start OMHG so other makers & misfits could … [Read more...] about Amy Turn Sharp Writing Workshop